Newsroom

Browse more

How Private Investments are Advancing the SDGs

By Erin O'connor | Sun Dec 02 2018

In 2016, the Sustainable Development Goals (SDGs) of the 2030 Agenda for Sustainable Development came into effect during the UN Sustainable Development Summit in New York. With a 15-year timeline, these goals encourage countries and various stakeholders to help improve the lives of people around the world. As we approach the 3-year mark, a number of organizations have started to report on the progress and approaches being used to help make these goals a reality by 2030.

One report, released in November 2018 by Convergence, outlined the importance of blended finance to achieve the SDGs in developing countries. Although investments (development assistance and foreign direct investments) total $1.4 trillion annually, the United Nations estimates that in order to achieve the goals, $3.9 trillion is needed, leaving a large funding gap of $2.5 trillion. Blended finance, for its part, actively aligns itself to 11 of the 17 goals, with the main alignment happening in Goal 17 (Partnerships for the Goals) and Goal 1 (No Poverty) (Convergence, pg. 1).

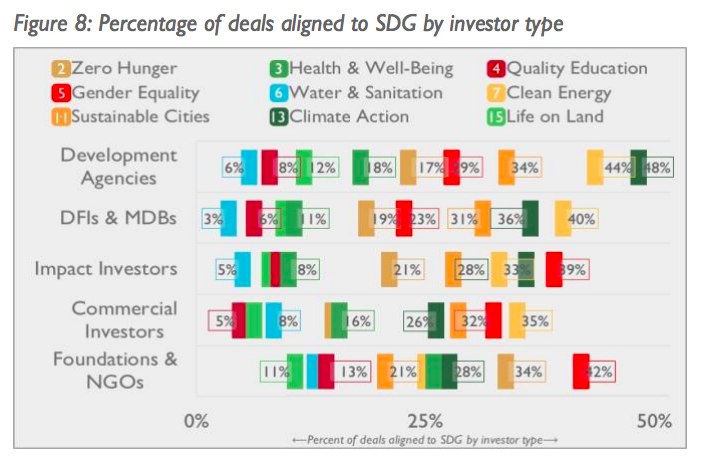

In terms of blended finance, most deals to date have focused on climate-change related SDGs and infrastructure-aligned SDGs. Currently, 48% of blended finance projects align with Goal 7 (Clean Energy), 43% of projects align with Goal 11 (Sustainable Cities) and 41% align with Goal 13 (Climate Action). Interestingly, different regions have also been targeted for specific blended finance solutions. Notably, in Sub-Saharan Africa, many solutions target Goal 9 (Industry, Innovation & Infrastructure) (pg. 2). Another interesting finding in this data brief is the alignment of various investor types with specific SDG goals. Development agencies and other public sector organizations align most frequently with Climate Action and Clean Energy, commercial investors with Gender Equality and Clean Energy, and impact investors with Gender Equality and Climate Action (see Figure 8 below for a more detailed breakdown) (pg. 3).

The key takeaway regarding the SDGs, blended/social finance and private investments is that investments alone cannot achieve the SDGs by 2030. Rather, it’s a combination of governments, private stakeholders, and other parties that will jointly bring these goals into fruition. Private investments tend to target some of the key themes of reducing poverty and sustainable infrastructure, but also put less emphasis on a number of the goals not related to these overarching themes. While private investments are playing a role in the SDGs, the report also highlights where further emphasis needs to be placed to achieve sustainable solutions for the future, and where some of that funding gap needs to be focused on in the years to come.

Here at RENEW, we are still doing our part to help push these goals forward, and we believe that we are actively doing work that supports 15 of the 17 goals, with a large amount of resources going towards Goal 8 (Decent Work and Economic Growth) and Goal 17 (Partnerships for the Goals). It could be said that the SDGs are baked into the very core of RENEW’s business model and the portfolio companies in which RENEW and the IAN invest. In our Third Annual Impact Report, we take a deeper dive into our direct impact with the SDGs and explain how RENEW and the Impact Angel Network are doing our part to make these goals a reality. Even though these goals can seem lofty, big changes do not happen without big dreams and even bigger goals to get you there.

Sources: Convergence, Data Brief, Blended Finance & SDG Alignment, November 2018 (Available to members of Convergence. To learn more about Convergence and their membership levels, please visit their website.)

Loading footer content...

Related Posts