Newsroom

Browse more

Building Ethiopia’s Investment Ecosystem

By Renata Makhoul | Tue Jan 08 2019

Part of RENEW’s purpose is to master the art and science of doing smaller sized equity investments in Africa. Smaller equity investments, those below 3M, are often not attractive for private equity (PE) funds to invest in since they cost the same, or sometimes more than the larger deals. Unfortunately, this creates a problem in many countries across Africa called the “missing middle”, and it makes it very hard for small and medium-size businesses (SMEs) to access capital and reach their full potential. RENEW‘s mission, in partnership with the Impact Angel Network and our partners at Global Affairs Canada, is to fill this gap in the capital market through new investment strategies. We are happy to report that in Ethiopia, it is working! In this blog, we want to share some interesting data we have discovered through some of our work, called sourcing.

Sourcing is one of the key activities done by an investment firm. Sourcing is the job of everyone at the company and it involves lots of meetings, driving around and doing creative activities to find the best companies. One of the sourcing activities we do at RENEW is called the PE500: a half-day workshop hosted at The Exchange for companies to learn about private equity and the investment process. The goal is for companies and owners to learn about how PE works, and for us to meet new businesses.

Throughout the 5-year term of the ABG project, our goal is to train 500 companies in Ethiopia through the PE500. Most of the companies that attend are looking for a partner to help them grow. Our aim with this training is to help owners learn about how equity investors can be a partner and then to help them learn how the equity process works.

At the PE500 workshop, we cover the following topics:

- Who is RENEW, who are our investors, why are we here, and what do we do?

- What is private equity, why is it important to companies in Ethiopia, and how is it unique?

- What are the benefits and drawbacks of working with an equity investor?

- How does the investment process work?

- How can you increase the chances of attracting an equity investor?

Through July and August of 2018, RENEW submitted a survey to 312 companies that have attended past PE500 trainings since the beginning of the ABG project. We received 150 responses to the survey. The purpose of the survey was to evaluate how the PE500 is helping SMEs improve their financial acumen and attract capital, given two of the intermediate outcomes of the ABG project are improved financial, environmental and social performance and success in attracting financing of SMEs to drive sustainable and responsible business growth. The overall target of the ABG project is to attract 52.5M Canadian Dollars (CAD) of financing, 15% of which should be provided to incubator companies. The PE500 training is a key tool for achieving these results. All data reported below was self-reported and provided by the entrepreneurs.

Key survey findings:

- 18 SMEs attracted financing after attending the PE500 training

- 4 of the 18 SMEs (or 22%) are led by women

- CAD 2.3M in additional capital was secured

- CAD 589K (or 26%) was secured by women-led businesses

- Of the 18 SMEs, 39% received loans, 27% received grants, 17% received equity, and 17% reported other sources of funding (e.g. founders, family and friends).

The above results indicate we have achieved 24% of the target for number of incubator companies attracting financing (18 of 75) and 15% of the target in terms of dollars (CAD 2.3M of CAD 15M).

We have seen more compelling gender results, since we were targeting only 5% of incubator financing to be received by women-led businesses.

More about the entrepreneurs that attended the PE500:

- Of the 312 companies to which the survey was submitted, 94 (30%) are women-led, and from the 150 companies that responded, 48 (32%) are led by female entrepreneurs.

- The PE500 training is designed for business leaders and members of the senior management team, and 87% of our respondents were general managers, founders and/or owners of the businesses.

Gender profile of the businesses that responded to the survey:

About their companies:

- The companies are diversified and represent many industries and sectors, but over 60% of the companies that attended the PE training to date operate in sectors that are relevant for Ethiopia’s economic development and exist within the government’s priority sectors. These companies are also relevant for RENEW’s investment criteria and pipeline.

- Of the 150 respondents, only 88 companies reported previous year revenues; of those who did report, average income was CAD 1.5M. However, this number may be misleading because large companies typically feel more confident in sharing their revenue, whereas small and medium sized companies, especially startups, often feel uncomfortable reporting small revenue results.

- 131 of the 150 companies reported employment data. On average, the companies have 68 employees in their workforce.

Growth plans:

At the end of each PE500 workshop, entrepreneurs are asked to complete a form providing feedback on the facilitation and content of the training. Additionally, we ask for more information about the attendees’ businesses (such as sales and employment numbers, as mentioned above), and ultimately if the attendees have interest in a one-on-one meeting with RENEW to learn more about potential financing. Most often, the feedback is very positive, and companies also provide valuable insights, such as their plans for growth as seen in the chart below.

The above chart illustrates the feedback from 104 companies regarding their plans for growth. The top initiative or plan for company growth involves increasing capacity (27%), followed by expansion and finally by working on and refining business strategy. The others did not specify.

What SMEs need:

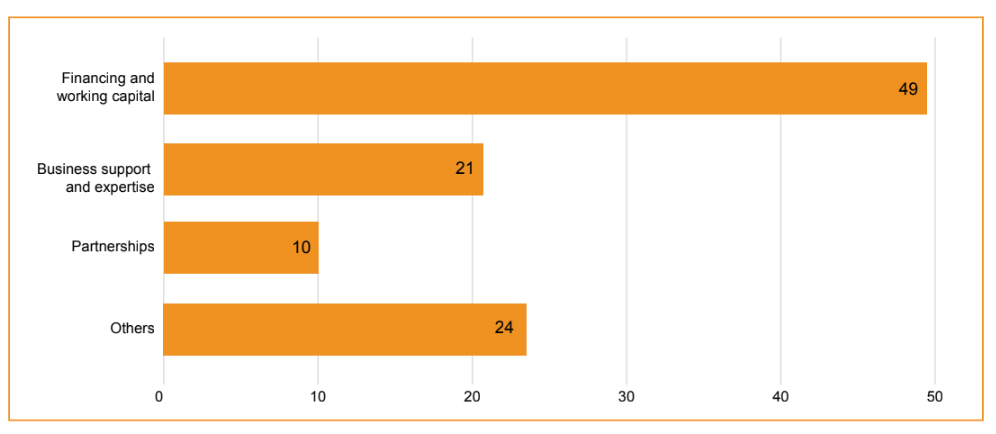

When companies were asked what they were most in need of, 47% responded with financing and working capital, followed by 20% reporting business support and expertise and 10% reporting strategic partnerships.

Job Growth:

On average, the companies that replied to the survey increased their number of employees by 44% in the current year compared to the prior year. When comparing the current year to two years ago, companies had increased their employee numbers by 71% on average.

Conclusion:

We believe that equity training can be a great tool to educate the market about a new funding source for companies in frontier markets like Ethiopia. These can also act as a great sourcing tool for Private Equity investors. We are excited about the results from the first 2.5 years of the program and look forward to enhancing the training to help high-quality SMEs attract capital and close the funding gap called the missing middle.

Loading footer content...

Related Posts