Newsroom

Browse more

A New Strategy for Africa and other Emerging Economies (Part 3): Angels Going Global

In search of the next Peter Thiel, Reid Hoffman and Mike Markkula...

If you’re asking “who are those guys?”, don’t worry. Unless you spend your evenings rubbing elbows with some of Silicon Valley’s elite, you may not realize that these are some of the most famous angel investors in U.S. history. They made pretty smart investments in a few companies that have become very big names. Here’s the rundown:

- Peter Thiel made a $500,000 angel investment in Facebook for 10.2% of the company.

- Reid Hoffman made an angel investment in both PayPal and LinkedIn.

- Mike Markkula invested $250,000 in Apple, became a 33% owner and employee #3.

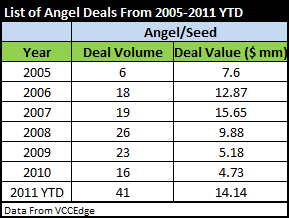

So we see how angel investing is not only a multi-billion dollar industry, we also see, if done well, it can have multi-billion dollar payouts.

The lead up to our next trend, begins when we look beyond Silicon Valley to places like Mumbai. Have you heard of Deepak Shahdadpuri? How about Naveen Tewari? No? That’s OK too. They are tycoons from India who have become aggressive angel investors. Remember how we said angel investing is on the rise in the U.S., and is now a $20B a year industry? Well, it’s on the rise in countries like India too.

We also see angels in developing countries taking on different angel characteristics from U.S. angels. They are not simply investing in their own country. They are investing along the economic continuum in India, the U.S. and U.K., and virgin markets like Africa.

What does this trend mean?

I believe it means that, not only is angel investing growing, but it is also going global. I find myself asking why? Why are angels from India investing in Mumbai, Addis Ababa, and San Francisco? Especially when angel investors traditionally invest close to home (within driving distance from their house) so they can oversee their investment and coach the entrepreneurs.I believe the answer may be a combination of three answers: (1) Angel investors from emerging economies have more risk tolerance than angels from developed countries, and are becoming “development-risk agnostic.” (2) The world is becoming flat. Old story, but the Internet and global travel allows angels to Skype with their investees from 3,000 miles away, and have global offices on Flight 611, seat #15C. And finally, (3) I believe global angels have a network of people they trust in the foreign countries in which they invest.

I believe #3 is important. Reports say 70% of foreign investors in agricultural lands in Ethiopia today are Indians. Presently, the Indian community in Ethiopia numbers approximately 1,500 nationals, around a hundred of which are businessmen, many of which occupy key positions in the UN and in Ethiopian Government. This is actually a common story across much of Africa.

So what I believe this means is:

- Angel investors are behind some of the greatest companies of our time.

- Angels from emerging economies are “development-risk agnostic” and invest along a continuum of economically developed countries.

- To become global, angels require people they trust in the country in which they are looking to invest.

Our next blog will begin to explore Impact Investing; and how this industry could help U.S. investors become global angels.

Loading footer content...

Related Posts